Data shows the cryptocurrency derivatives market has suffered a massive amount of liquidations after the Bitcoin flash crash during the past 24 hours.

Bitcoin Has Witnessed Significant Volatility During The Last Day

BTC has displayed some wild price action in the past day, with both a high of $103,500 and a low $90,500 occurring inside a narrow window. The move to the latter level, in particular, was so sharp that it could only be described as a flash crash.

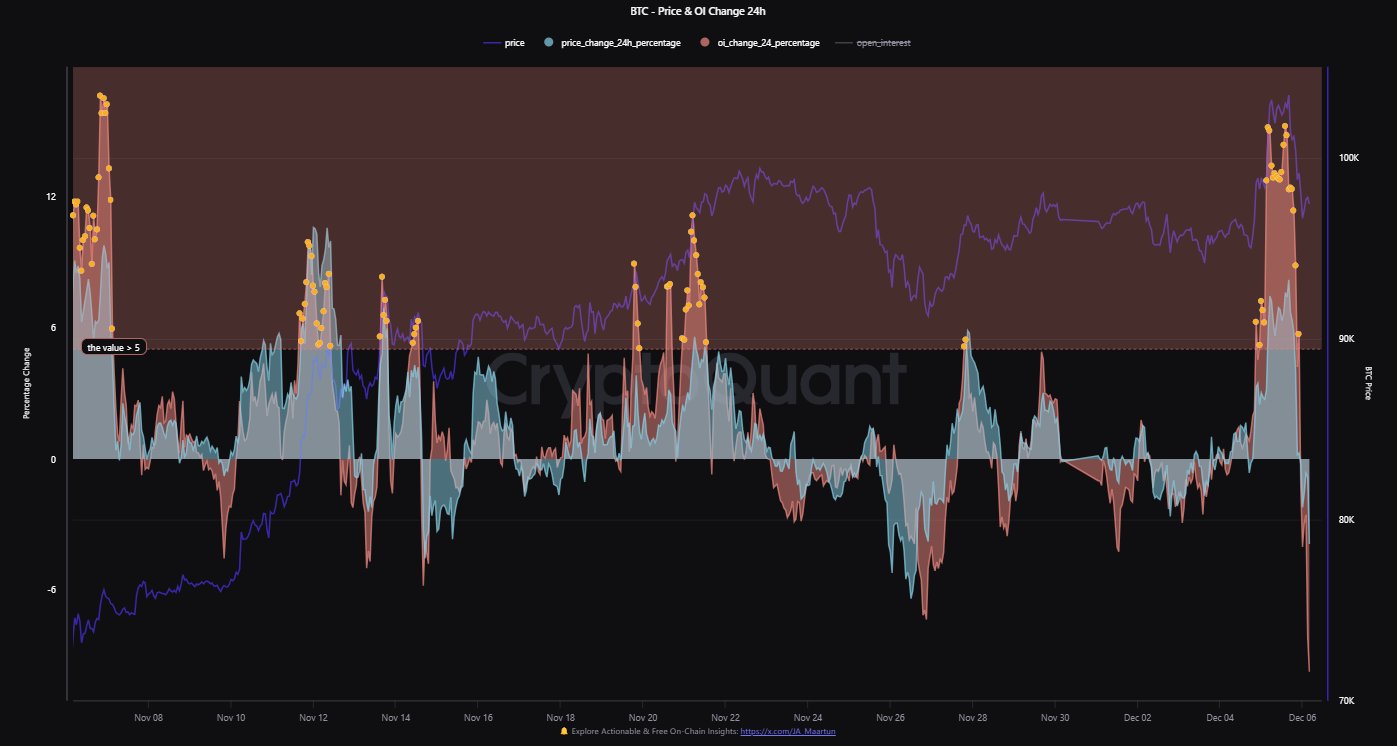

Below is a chart that shows how the asset’s recent trajectory has been like.

From the graph, it’s visible that the sharp red candle only lasted briefly, as the cryptocurrency was quick to rebound back to higher levels. After the recovery, the coin is trading at around $98,000, which means it’s still down around 5% since the top.

In usual fashion, the other top digital assets have also followed BTC in this bearish price action, but the likes of Ethereum (ETH) and Solana (SOL) have proven to be more resilient as their prices are down just 2% during the past day.

The latest market-wide volatility has meant that chaos has occurred over on the derivatives side of the cryptocurrency sector.

Cryptocurrency Longs Have Just Witnessed A Liquidation Squeeze

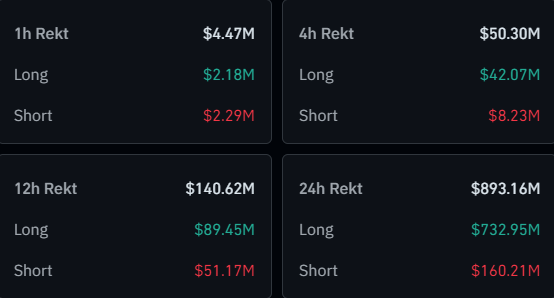

According to data from CoinGlass, the cryptocurrency derivatives market has suffered a large amount of liquidations as assets across the sector have seen sharp price action.

As displayed in the above table, cryptocurrency derivatives positions worth a whopping $893 million have found liquidation in the last 24 hours. A contract is said to be “liquidated” when the exchange forcibly shuts it down after it amasses losses of a certain degree.

Almost $733 million of these liquidations have involved long contracts, which represents 82% of the total. This steep dominance of the longs is naturally a result of the net bearish action that Bitcoin and others have gone through.

A Mass liquidation event like this latest one is popularly known as a “squeeze.” Since longs made up for the majority of this squeeze, it would be called a long squeeze.

The long squeeze that the derivatives sector has just suffered may perhaps have been the obvious conclusion to the red-hot market conditions that were developing in its lead-up. As CryptoQuant community analyst Maartunn has pointed out in an X post, the Open Interest shot up alongside the Bitcoin surge.

Generally, whenever derivatives positions explode during a rally, it means that the surge is leverage-driven. Price moves of this type can unwind in a volatile manner.

The Open Interest rose by more than 15% in the recent Bitcoin run, which is considered a very significant amount. When the price reversed its direction, all these leveraged longs were caught up in the squeeze, which only provided further fuel for the crash, explaining its particularly sharp nature.

Credit: Source link